Is a houseboat HMDA reportable? Generally speaking, no. However, some properties are excluded from reporting. Among these are houseboats. This article will explore what to do if you’re in the situation of having to report your boat. You can also find out if you should file a report if you already own one. And if you don’t, you can always refinance your houseboat loan.

*This post may contain affiliate links. As an Amazon Associate we earn from qualifying purchases.

Getting a houseboat loan

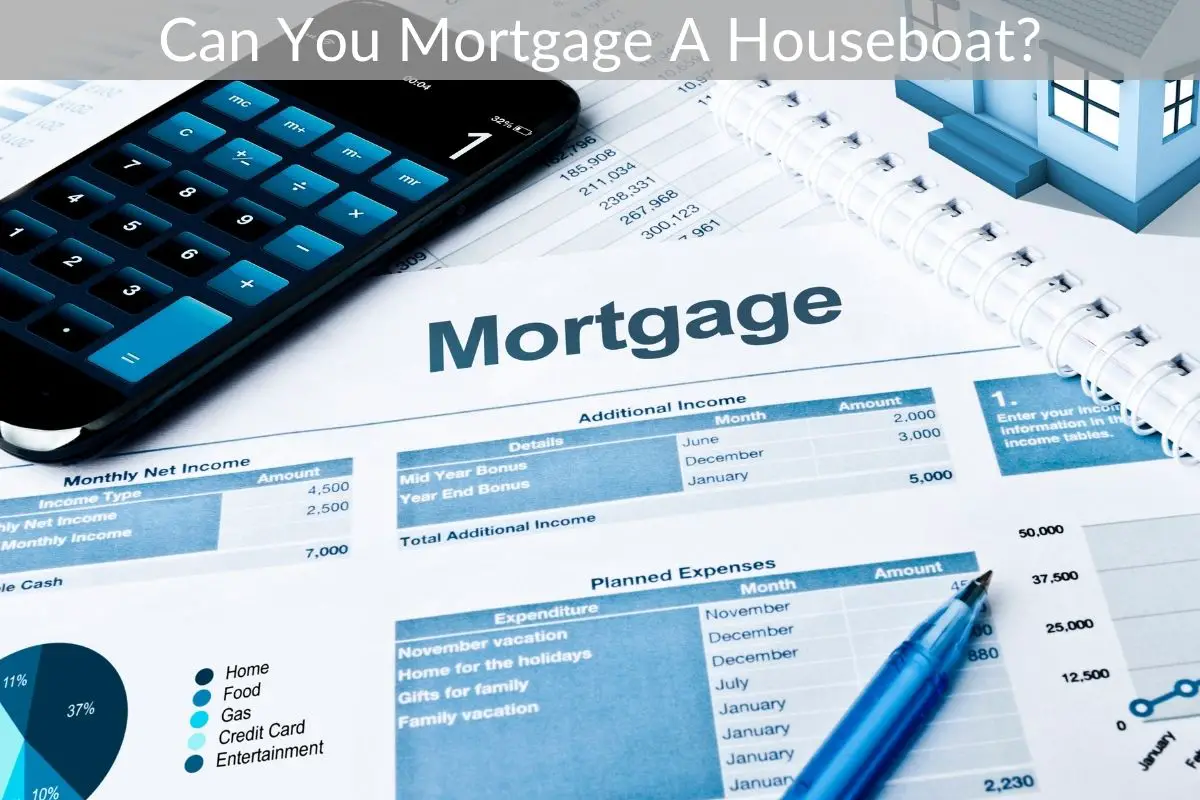

Getting a houseboat loan is not an easy task. These loans are often difficult to obtain, but there are some alternatives. There are several different types of financing available, and each will require different qualifications. Ultimately, the best option will depend on your personal goals, financial situation, and the amount of financing you need. Listed below are the most common forms of financing available. To learn more, please contact your banker or credit union.

The type of credit score required for a houseboat loan depends on the lender and type of financing. Lenders usually require excellent to good credit. It is therefore important to know your credit score before applying. The amount of the down payment is determined by the size of the houseboat you wish to purchase, your financial history, and the type of loan you plan on applying for. Generally, you will need to put down a significant amount of money, so it is important to gather all the necessary documentation.

Another alternative is a home equity line of credit. Unlike traditional mortgages, houseboat loans are not as long-term as other types of loans. Typically, they last between fifteen and twenty years. A houseboat loan is not a good option if the boat is not well-maintained. A houseboat can depreciate over the first couple of years, and then slowly depreciate over the next decades.

The amount of money you need to purchase a houseboat is highly dependent on the economy and your credit history. Generally, a houseboat loan will cost between $50,000 and $150,000, based on your income and credit score. A large down payment is usually required to obtain favorable loan rates, but some people choose to pay for most of their boat upfront in order to reduce their monthly payments.

Getting a houseboat loan is harder than a traditional mortgage, though there are several different types of financing available. While the government may consider houseboats a home, it is not a legal term for a houseboat. Houseboats on land are outside the jurisdiction of the coast guard, so they would probably be classified as a mobile home. That means you would have full search and seizure rights. As for houseboat loans, banks rarely consider them to be home loans, so the government won’t lend on them. However, houseboats are not considered houses, and that is why they are not easily accessible.

Because HMDA requires lenders to disclose certain information to the credit bureaus, it’s important to review the requirements before taking out a houseboat loan. If you intend to use your houseboat as a vacation home, you’ll have to disclose the loan details. For example, you need to disclose how much you spent on the boat and whether you were able to get a good deal on it. Similarly, a loan for a boat can be an excellent option, as long as it is based on equity.

Getting a houseboat hmda report

Houseboats are not for everyone. They are often considered portfolio loans, which means that the lender will pay close attention to liquidity and history of other financial assets. Getting a houseboat HMDA report is therefore vital to ensuring the safety and security of your investment. The down payment for a houseboat is typically high, usually between 20 to thirty percent of the total price. However, some lenders may require a smaller down payment. If you have good credit, you may want to consider making a larger down payment.

In addition to inspections, a houseboat HMDA report can help you avoid fines, which are a necessary part of buying a houseboat. The rule has been enforced to prevent fraud, and has triggered a number of lawsuits. As a result, it is important to get your HMDA report before making any major purchases. While a houseboat HMDA is not as stringent as a motorboat, it should be inspected before you buy it.

Getting a boat loan refinance

Getting a loan for a houseboat is not an easy task, especially if you have a bad credit score. While some lenders may waive this requirement, others may insist on high scores. However, you can improve your credit by consulting your Equifax credit report. A loan application will also require a down payment, which varies from lender to lender. The amount you need to put down will depend on the size of the houseboat, your financial history, and the lender you choose. In most cases, a down payment of 20% of the total purchase price is required.

Before applying for a houseboat loan refinance, you should know what type of mortgage you have. Many lenders specialize in house boat loans. Some of these lenders are well-known in the marine lending industry, including N.F.. Another option is to apply for a home equity line of credit (HELOC), which allows you to borrow up to 85% of the value of your home. While this option offers you a low rate, it also puts your home at risk.

Getting a houseboat loan refinance is not as easy as getting a regular mortgage, and can be difficult. Houseboat financing may be more difficult than obtaining a traditional mortgage, because of the different liquidity requirements. Houseboat loans often require higher down payments and stricter loan terms than a traditional mortgage, but they are still an excellent option. If you have low credit scores, it may be easier to qualify for a houseboat refinance than a traditional mortgage. If you have bad credit, you may also need to get a houseboat refinance loan.

When applying for a houseboat loan, you should remember that the monthly payment is directly related to the amount of money you borrow and the length of time you take to pay it off. The longer your houseboat loan term, the larger your payment will be. Usually, houseboat loans are for a maximum of five years, although older boats cannot be financed for as long as newer models, so the monthly payment will be higher. You will also need to have a down payment or trade-in value. Once you have this money in your bank account, you can apply it to the purchase price of your houseboat.

A traditional boat loan may only be good for a houseboat, but it may not be the best choice for you. Personal loans are unsecured, and the maximum loan amount is often a little over a year. But if you want to get a houseboat that costs more than that, you may need to find another type of loan. However, you may need to pay more than the original loan amount in order to secure the boat loan you need.